Table of Contents

Table of Contents

- What is a business valuation?

- Calculating how much a janitorial business is worth

- 2. Using EBITDA multiples

- Factors that affect how much you can sell a cleaning business for

- How to increase the value of your commercial cleaning business

- Leverage technology to increase how much your janitorial business is worth

Understanding the true value of your cleaning business is critical when you decide to sell. However, accurate valuation doesn’t just come down to crunching numbers—timing and strategy can significantly affect the sale.

Navigating the complexities of janitorial service business valuation can be daunting.

This article provides an overview of the various commercial cleaning business valuation methods and explains some critical factors in identifying the optimal time to sell.

Whether you’re looking to maximize your return, pivot into new ventures, or want greater insight into your company’s market standing, this blog can help.

What is a business valuation?

Business valuation goes beyond just the numbers on your company’s balance sheet. While tangible assets are a component of the valuation process, it also includes intangible assets, market positioning, and the future earnings potential of a business.

Owners use business valuations for many reasons, including:

Selling a business

Bringing on partners who will have an ownership stake in the company

Securing a loan

A business valuation takes into account:

Financial performance, including monthly cash flow

Market conditions

Future earnings potential

This holistic approach provides a comprehensive understanding of a business’s worth for stakeholders, investors, potential buyers, and decision-makers.

Calculating how much a janitorial business is worth

There are multiple methods for valuing a cleaning business, each with pros and cons and specific use cases.

You’ll need accurate financial data for all methods, such as net profit, net sales, and gross revenue.

There are three standard methods for finding the valuation of cleaning businesses:

SDE multiples

EBITDA multiples

REV multiples

A business broker can take the guesswork out of choosing the ideal methods to calculate the value of a business and the optimal selling price for prospective buyers. Or, work with a business appraiser if you’re conducting valuation for internal reasons.

1. Using SDE multiples

The SDE, or seller’s discretionary earnings, approach assesses the value of a small business based on its owner's discretionary earnings. This provides a more holistic view of the financial benefits available to the business owner than simply looking at net income.

The SDE multiples method is relevant for small to medium-sized commercial cleaning businesses, where the owner/operator plays a vital role in day-to-day operations.

→ To calculate the value of the business using SDE multiples, use the formula:

SDE = net income + depreciation/amortization + owner’s salary and benefits + discretionary expenses.

Then, multiply the SDE by an industry-specific multiplier derived from comparable sales of businesses in the same or similar industries.

→ For example, if a business with an SDE of $200,000 sold for $1 million, the multiplier would be 5 ($1,000,000 / $200,000). Take an average from a few area comps.

SDE x industry-specific multiple = company value

Pros | Cons |

Holistic measure Easy to understand Relevant for owner-operators | Less applicable for larger businesses Depends on comparable sales data Can be subjective |

2. Using EBITDA multiples

Small to medium-sized commercial cleaning businesses get by just fine with SDE multiples, but larger cleaning and janitorial service corporations with complex financial structures and professional management teams require a more sophisticated equation to determine how much their cleaning business is worth.

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. It represents the operating profitability of a business by applying a multiple to EBITDA to determine the value of your business.

→ Calculate EBITDA with this formula:

net income + interest + taxes + depreciation + amortization.

Like with SDE multiples, you need an industry-specific valuation multiple, which will be based on sales comps.

For each comparable business, divide the sale price by its corresponding EBITDA. This calculation provides the EBITDA multiple used in the valuation.

→ For example, if a business with an EBITDA of $500,000 sold for $2.5 million, the EBITDA multiple would be 5 ($2,500,000 / $500,000).

Then, take the EBITDA x industry-specific multiplier to find a fair market value estimate for valuing a janitorial business.

Pros | Cons |

Focuses on operational profitability The standard metric used for mergers and acquisitions Allows for consistent comparisons | Excludes capital expenditures Economic conditions can impact reliability Can be manipulated to not accurately represent business cash flow |

3. Using REV multiples

The REV, or revenue, multiples approach involves assessing the value of a business by applying a multiple to its total annual revenue, providing insight into how the market values the company based on its top-line financial performance.

To calculate how much you can sell a cleaning business for, multiply the total annual revenue of a company by an industry-specific multiplier.

The cleaning business sales multiple is typically derived from sales data of similar businesses. Divide the sale price by its corresponding total revenue for each comparable business. This calculation provides the revenue multiple used in the valuation.

→ For example, if a cleaning service company with total revenue of $1 million sold for $5 million, the revenue multiple would be 5 ($5,000,000 / $1,000,000).

Use this formula:

total revenue x industry-specific multiple = estimated business value.

Revenue multiples are an ideal valuation strategy for businesses in growth mode, with unique market positioning, or operating in an industry where revenue is a key indicator of value.

Pros | Cons |

Applicable to startups or growth-focused companies Easy to use Direct correlation to revenue | Overlooks profitability challenges or opportunities Depends on comparable sales data Doesn't account for revenue quality |

Factors that affect how much you can sell a cleaning business for

As demonstrated by the methods above, commercial cleaning company valuation doesn’t use standardized metrics. Instead, it is influenced by multiple factors, including:

Stability and terms of contracts

Strength of client relationships

Specialization or niche focus

For example, long-term contracts with reliable clients enhance a janitorial business's stability and value, while a specialization in environmentally friendly cleaning services may attract a specific market segment.

Broader economic factors also play a crucial role in the valuation of janitorial businesses, such as:

Disposable income levels

Corporate spending on cleaning services

Entrepreneurs who use a proactive approach can strategically enhance their commercial or residential cleaning enterprise by focusing on those key aspects that increase business value.

How to increase the value of your commercial cleaning business

To consistently increase the value of your commercial cleaning business, actively manage the company and make ongoing improvements to processes, products, and services.

Ways to increase the value of your commercial business include:

Cost reduction by optimizing supply chains and renegotiating vendor contracts

Diversification into new markets or client bases

Customer marketing initiatives that drive repeat business from your customer base

Integration of cleaning industry trends, such as eco-friendly efforts like waste reduction and energy efficiency

Leverage technology to increase how much your janitorial business is worth

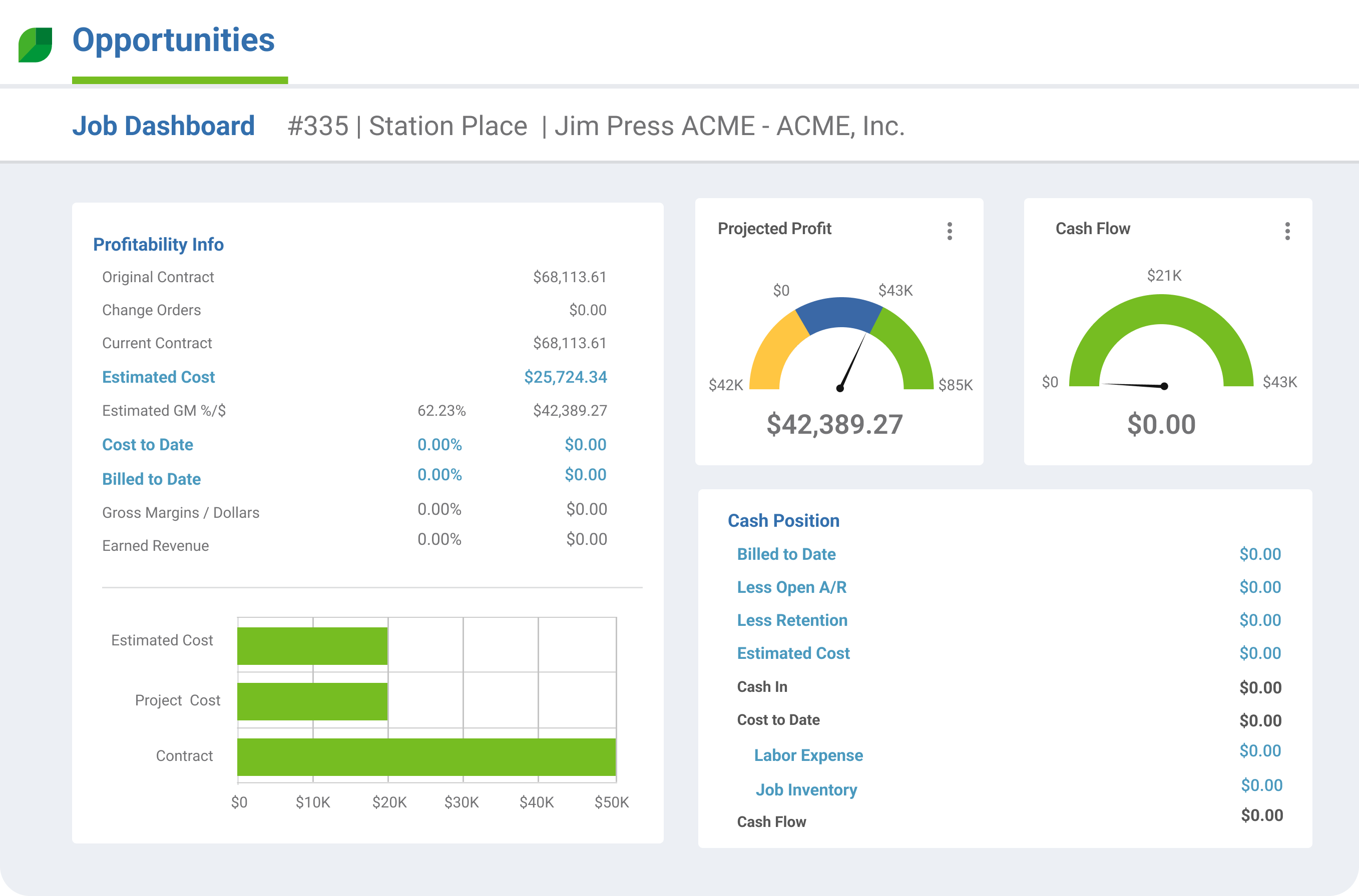

Business management software enhances operational efficiency, growing profit margins and increasing business value. Aspire is the only end-to-end business management system that provides cleaning contractors visibility into every aspect of their operations.

Real-time data enables business owners to make informed decisions that improve sales, productivity, accountability, and profits.

With tools for managing resources, customer relationships, scheduling, and invoicing, Aspire unlocks limitless growth potential.

Schedule a free demo to learn how the software can empower growth at your company.