Cleaning business owners can grow their profit margins by conducting an in-depth analysis of operations, pricing strategies, and sales methods.

The percentage of revenue a business retains after deducting costs is a metric of its financial health and growth potential.

Consistent profit tracking gives cleaning business owners actionable insight into operational efficiency and sales performance while minimizing potential financial risks.

This guide describes calculating healthy profit margins, understanding critical factors that affect profit, and exploring strategies to boost cleaning business profits.

Average profit margins for a cleaning business

A cleaning company’s profit margin demonstrates its ability to manage costs and spending and to price its cleaning services competitively.

According to Entrepreneur, most janitorial service business owners aim for a net profit of 10% to 28% of gross sales. According to IBISWorld market research, profit for janitorial service companies in the U.S. over the past five years remained constant at 6.3%.

Cleaning contractors set target profit margins in their initial business plan and adjust profit goals as the business grows to reflect changing business objectives.

How to calculate profit margins for your cleaning company

Monitor financial data and use the following calculations to understand profitability. Profit margin calculations provide insight into a company’s financial condition.

Different types of profit margins

The three main types of profit margins include gross, operating, and net profit margins.

Gross profit margin

Gross profit, or gross income, is the amount of revenue left after subtracting the cost of goods and services (COGS) from total revenue.

For example, if Cleaning Company A earned $300,000 in revenue and it cost $130,000 to deliver services, that leaves $170,000, representing a 56% gross profit margin.

A gross profit margin measures a company’s profitability against the direct costs of business.

Operating profit margin

An operating margin measures the profit a business earns from sales or services after deducting operating expenses from revenue, including:

Administrative salaries and labor costs

Equipment depreciation and amortization

However, operating costs do not include interest and taxes.

For example, if Cleaning Company A incurred $160,000 in operating costs against their $300,000in revenue, that would translate to $140,000 in operating income. This means the company has a 46% operating profit margin.

This metric shows whether a business efficiently manages operating costs and its ability to generate future operating income.

Net profit margin

Net profit—also referred to as net income, net earnings, or the bottom line—is the amount of remaining revenue after deducting all expenses. This includes COGS, operating expenses, interest, taxes, and other non-operating expenses.

For example, if all of Cleaning Company A’s expenses totaled $240,000, that leaves $60,000 in profit from its $300,000 in revenue, which represents a 20% net profit margin.

Net profits clearly show a company’s cash flow and financial strength. Lenders also examine this metric before loaning funds to businesses.

Formula for calculating profit margins

Cleaning contractors track profit margins to improve operations and financial performance. To calculate the profit margins, follow these steps:

Gross profit margin

To find the gross profit margin, first determine gross profit.

Gross profit = Revenue - COGS

Next, calculate the profit margin.

Gross profit margin = Gross profit/Revenue x 100

Using the numbers from the example above, the calculation looks like this:

$300,000 revenue - $130,000 COGS = $170,000 gross profit

$170,000 gross profit/$300,000 revenue = .56

0.56 x 100 = 56% gross profit margin

Operating profit margin

To calculate operating profit, first calculate operating income.

Operating income = Revenue - Operating expenses

Use operating income to determine the operating margin.

Operating margin = Operating income/Revenue x 100

For example, the formula looks like this:

$300,000 revenue - $160,000 operating costs = $140,000 operating income

$140,000 operating income/$300,000 revenue = .46

0.46 x 100 = 46% operating profit margin

Net profit margin

Calculate net profit by using the following formula.

Net profit = Revenue - Total expenses

Next, determine the net profit margin.

Net profit margin = Net profit/Total revenue x 100

For example:

$300,000 revenue - $240,000 total expenses = $60,000 net profit

$60,000 net profit/$300,000 revenue = 0.2

0.2 x 100 = 20% net profit margin

Accurately calculate profit margins with Aspire commercial cleaning business software.

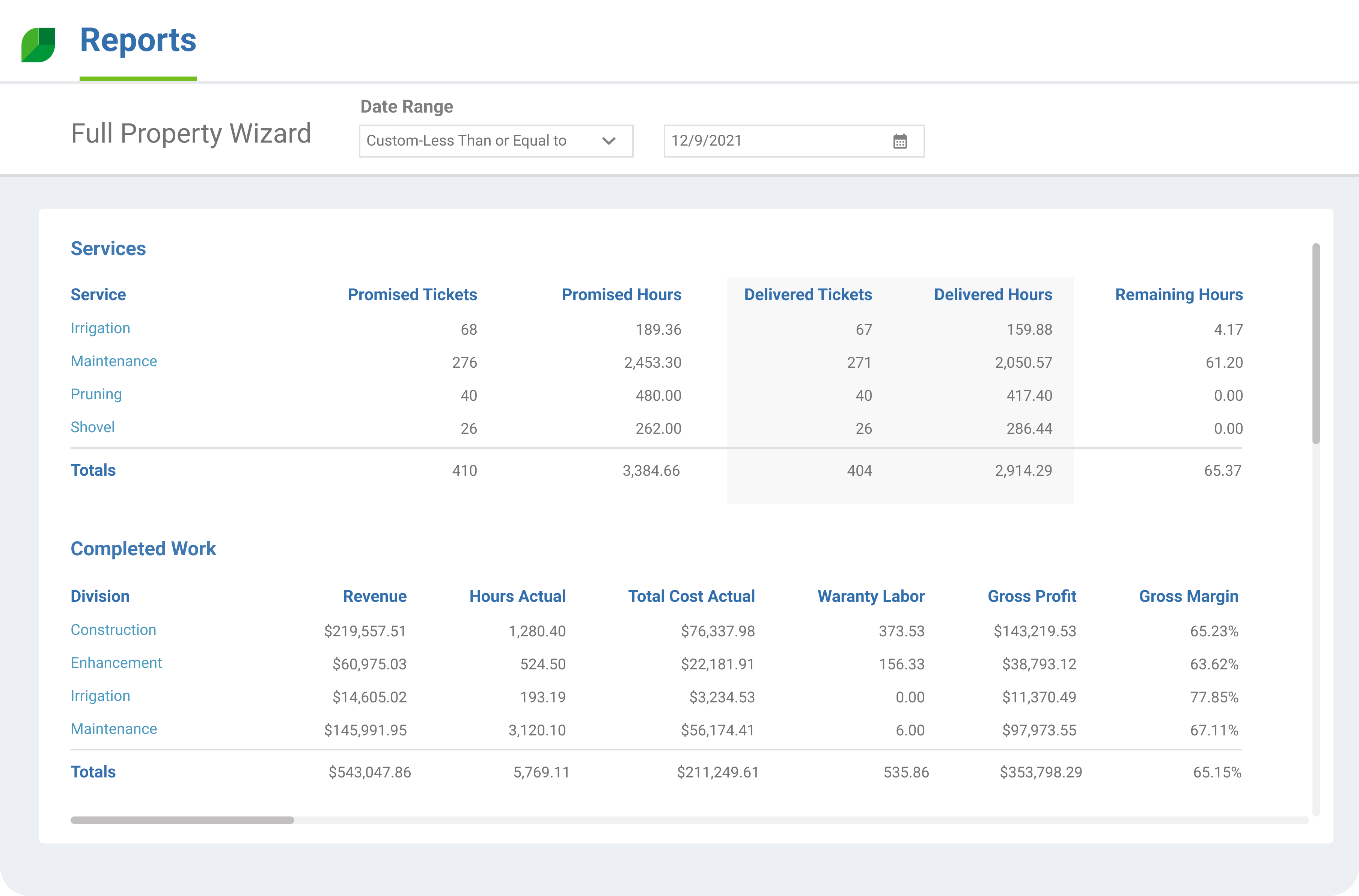

Aspire’s flexible profit and loss reporting shows gross profit and margin in real time, with the ability to filter data by branch, division, property, or team.

Precise data enables cleaning contractors to make proactive decisions to improve individual job and overall business performance.

Key factors affecting profit margins

While analyzing industry benchmarks helps owners evaluate business profitability, actual profit margins differ based on various factors, including:

Type of cleaning services

Low or high demand in the market

Labor costs and cleaning supply expenses

Operational efficiency

Business growth stage

Specialized cleaning lends itself to a higher profit return because of limited competitors in the market.

Economic factors, such as rising labor and supply costs, can potentially lower profits. Strategies to combat these factors include improving operational efficiency, increasing referrals and sales, and identifying additional revenue sources.

How to increase profit margins

Successful cleaning businesses implement strategies to improve operational efficiency, quality service, and customer satisfaction. Follow these tips to boost profit margins in your business.

Improve business efficiency

Efficient job management and streamlined workflows empower cleaning teams to do more in less time. Aspire cleaning business software automates tasks and connects teams to enhance efficiency and profit.

Automate tasks: Automate daily tasks to save time. Aspire provides estimating, scheduling, and management tools for real-time job costing and performance updates.

Improve team communication: Connect teams using a mobile app. Aspire’s mobile app enables team members to see live schedule updates and checklists for detailed tasks. Users can also log visit notes, upload photos, and create, assign, or respond to issues.

Measure team performance: Improve efficiency with mobile time tracking and a site inspection tool to assist in proactive training. Performance tracking reduces callbacks and increases customer satisfaction.

Rethink your pricing strategies

Pricing depends on job costs, market demand, and business objectives. Successful cleaning businesses use the right marketing strategy to set prices and find the right balance between competitiveness and profitability.

Common cleaning industry pricing strategies include:

Hourly pricing: An hourly rate charges customers by the hour. Cleaning businesses include direct and indirect costs and appropriate markups to remain profitable.

Square-foot pricing: This pricing model charges customers by facility size and requires accurate data on how long an employee takes to perform specific cleaning services.

Flat fee: This strategy charges one fee for specific cleaning services. It requires accurate estimation of time and supplies and generates more profit when employees work efficiently.

Tiered pricing: This strategy provides service options at different price points. This encourages customers to compare your packages and often results in upsells, especially when customers understand the value of a top-tier package.

Dynamic pricing: This pricing structure fluctuates based on market changes and demand. A higher demand for a service results in a higher price.

Value-based pricing: Value-based pricing, one of the most profitable strategies, sets a price based on what your target market will pay. Customers often agree to pay a higher rate when they perceive a greater value for the service.

Cleaning companies use multiple pricing strategies and adjust prices to meet business financial goals.

Upsell additional cleaning services

Upselling encourages customers to consider comprehensive cleaning or an add-on service, increasing business revenue and profit.

To effectively upsell:

Analyze usage patterns: Identify your most popular cleaning jobs with new clients and how you can attractively package services to promote upselling.

Obtain customer feedback: Use customer surveys, questionnaires, or social media posts to discover additional services or packages customers prefer.

Train sales: Train sales staff on services, including recurring cleaning contracts. Offer discounts for a higher-priced service or package to encourage customers to choose a premium option.

Determine the best price for add-on services, such as carpet cleaning or window cleaning. Consider offering additional services to generate revenue, such as green cleaning, ceiling cleaning, or other deep-cleaning services.

Implement cost-cutting measures

Identify areas to reduce overhead costs, eliminate unnecessary expenses, and optimize operations.

Consider these cost-cutting measures to increase profit:

Identify nonprofitable services: Analyze job data to determine how to price or deliver services profitably. Consider eliminating unprofitable services.

Examine vendor contracts: Research vendors to ensure you get the best prices and terms. Consider renegotiating agreements and find out how to qualify for discounts and savings.

Implement inventory management: Track inventory at multiple locations to avoid unnecessary stockpiling—plan and purchase in bulk for various jobs for the greatest cost savings.

Aspire’s integrated janitorial business software empowers businesses to control costs, track inventory, and gain real-time visibility into job profitability.

Improve your profit margins by using the right tools

Aspire’s end-to-end functionality enables cleaning contractors to increase profitability through consistent bids, accurate job costing, and real-time performance updates.

Aspire improves profitability through:

Live ticket management: View a detailed breakdown of actual hours, supplies/materials, labor costs, equipment, and subcontractor costs.

Team tracking: Measure job performance with mobile time reporting and material tracking. Time and location geo stamps, site inspections, and visit checklists keep teams accountable.

Automated profitability reports: Use a customizable job dashboard to see actual costs and profits for each project.

Aspire provides comprehensive insight to drive efficiency, increase profit, and continue business growth.

Request a demo to see how Aspire helps businesses grow profit margins.

Frequently Asked Questions (FAQs)

Find answers to commonly asked questions about the professional cleaning business.

Q1. What type of cleaning is the most profitable?

According to IBISWorld, commercial cleaning services typically generate more profit than residential cleaning businesses. Compared to small home cleaning services, commercial cleaning businesses provide services more frequently and charge higher prices.

Specialized commercial services, such as sanitization and disinfection, provide opportunities for increased profitability due to technical equipment and special training.

Q2. How much do cleaning companies make?

According to ZipRecruiter, professional cleaning business owners make $127,973 annually.

The amount of money a cleaning business makes depends on several factors, such as small-business startup costs, business size, operational efficiency, pricing, and labor and supply costs.

Starting your own cleaning business can be profitable when done properly.