Table of Contents

A chart of accounts is crucial for landscaping businesses to track their finances and clearly understand their company’s financials.

Our free landscaping chart of accounts template will make financial tracking easier for managing revenue, expenses, and assets—it simplifies bookkeeping, improves cash flow, and empowers better decision-making.

Download the template to start organizing your finances and ensure your landscaping business remains profitable.

Introducing your landscaping chart of accounts template

Our landscaping chart of accounts template is industry-specific, identifying every aspect of your business, from lawn care services to equipment rental costs.

As a business owner, you can adjust categories for specific services, such as:

Hardscaping

Design services

Snow removal

Seasonal maintenance contracts

A chart of accounts will help you monitor profit margins, find cost savings, and make informed decisions on pricing and growth.

The template covers key sections such as:

Revenue accounts to track income from different landscaping services

Expense accounts to monitor operational costs like materials and labor

Asset and liability accounts for tracking owned equipment, loans, and other financial obligations

Using this chart of accounts will simplify your bookkeeping and ensure all financial activity is in your financial statements.

What is a chart of accounts?

A chart of accounts lists all the financial accounts in your landscaping business. It categorizes transactions into assets, liabilities, revenue, and expenses so you can track and manage your finances.

→ Each account has a unique number or code to track and report efficiently.

A well-organized chart of accounts will ensure all income and costs are recorded accurately and can be seen in your financial statements.

Accrual accounting is important because it recognizes expenses when they are incurred, not when cash is exchanged. Thus, financial records will reflect liabilities, assets, and costs before payment is made.

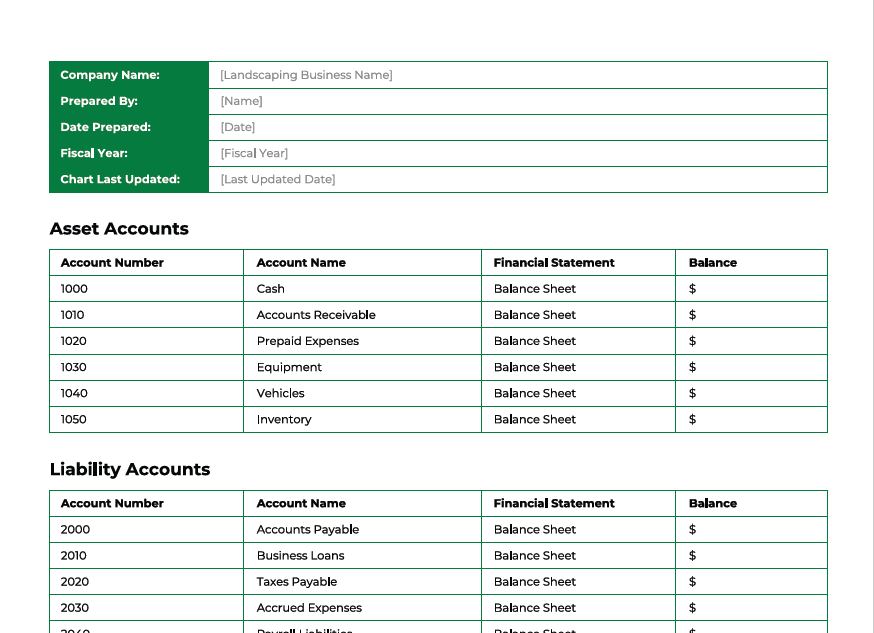

The chart typically includes:

Asset accounts to track what your business owns, like equipment, office supplies, or vehicles

Liability accounts for debts and financial obligations like loans, rent expenses, credit card payments

Revenue accounts to record income from services like lawn care and landscaping projects

Expense accounts to detail labor, materials, and equipment rental

Why does your landscaping company need a chart of accounts?

A chart of accounts is crucial to manage your landscaping business finances. With a properly set up chart, you can:

Maintain accurate, organized records by categorizing every transaction into specific accounts. Reduce errors or misplaced entries and make sure all expenses, revenue, and assets are accounted for.

Build your understanding of your business’s financial health by analyzing changes in account balances over time. Identify trends, evaluate performance, and make data-informed decisions.

Enhance financial analysis and decision-making by reviewing profit margins, creating accurate budgets, and finding areas to cut costs or invest more.

A good chart of accounts follows tax reporting requirements, so it’s easier to file returns and claim deductions and streamline reporting to investors and lenders with clear and organized financial data.

What are the key sections in a landscaping chart of accounts?

A well-organized chart of accounts will sort your financial data into main categories so you can track everything about your landscaping business.

The sections usually include:

Income accounts

Expense accounts

Assets

Liabilities

Equity

These sections will give you a complete picture of your business's financial situation and help you make data-driven decisions.

The balance sheet shows a company’s short-term obligations to creditors by recording accounts payable as a current liability.

Each section in a chart of accounts is essential for managing your business's financial activities, from tracking revenue streams to recording expenses, assets, and liabilities.

Income Accounts

Income accounts track the revenue of your landscaping business.

These accounts will categorize the different services you offer so you can identify the most profitable.

For a landscaping business, these might include:

Lawn care services

Landscaping projects (e.g., hardscaping, landscape design)

Irrigation system installation/repair

Seasonal maintenance contracts

Snow removal services

By tracking income for each service type, you’ll get a better view of which areas of your business are doing well and which need more attention or adjustments in pricing.

→Knowing the profitability of hardscaping services vs regular lawn mowing will help you make better decisions on where to allocate resources or adjust pricing.

A well-organized income section will help you see which services generate the most revenue, making strategic growth planning straightforward. A comprehensive understanding of your revenue streams is vital for pricing, budgeting, and forecasting.

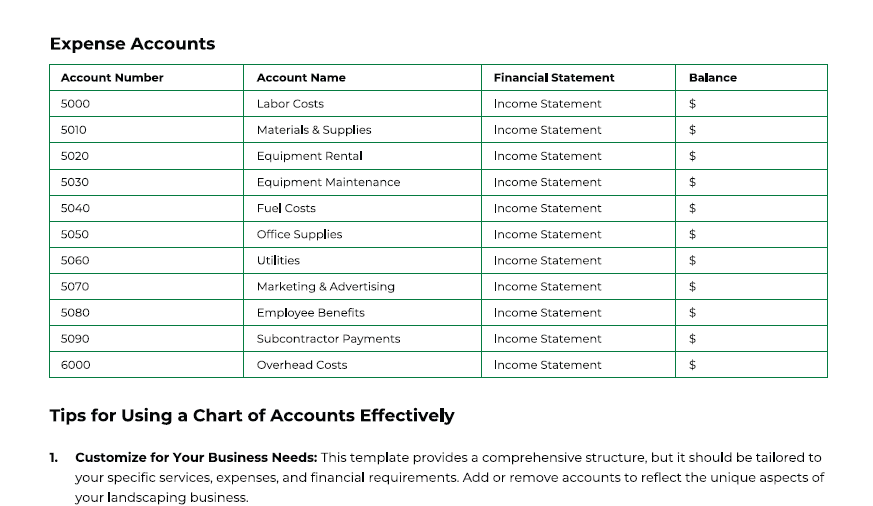

Expense Accounts

Expense accounts will document all the costs of running your landscaping business.

A breakdown of expenses, from labor costs to supplies, will help you maintain financial control.

For a landscaping business, these might include:

Labor costs: Wages, benefits, and payroll taxes for employees and subcontractors.

Materials and supplies: Items like mulch, plants, soil, and fertilizer.

Equipment rental and maintenance: Expenses related to renting or maintaining your tools and machinery.

Fuel and transportation: Costs associated with trucks and other transport equipment.

Managing accounts payable improves cash flow management and makes for better vendor relationships.

Tracking expenses provides visibility into overspending and cost-saving opportunities. For example, if equipment rental costs increase, buying the machinery outright may be more cost-effective.

Managing operating expenses will help you better forecast your cash flow to meet your financial obligations and stay profitable.

Assets and Liabilities

Asset accounts will record what your business owns, and liability accounts will record what your business owes. Together, these accounts provide a snapshot of your business’s financial position.

Accounts payable is the money a company owes to its suppliers for goods and services provided.

For a landscaping business, these might include:

Cash: The money currently in your accounts

Accounts receivable: Money owed to your business for completed services.

Inventory: Materials like fertilizers, plants, and equipment parts.

Vehicles and equipment: Trucks, lawnmowers, and other essential tools.

Liability accounts track debts and obligations, including:

Accounts payable: Amounts owed to suppliers for materials or equipment and subcontractors.

Business loans: Any loans taken out for purchasing equipment or vehicles.

Taxes payable: Any owed business taxes.

Payroll liabilities: Amounts owed for employee wages or benefits.

By monitoring these accounts, you’ll know exactly how much capital is available for growth or to weather the slow times.

Equity Accounts

Equity accounts will show the owner’s interest in the business after deducting liabilities from assets.

They will show the net worth of your landscaping business.

For a landscaping business, these might include:

Owner's equity: The total value of the owner’s investment in the business.

Retained earnings: Profits reinvested back into the business over time.

Equity accounts help you track your business's growth and are part of your overall financial picture. Monitoring retained earnings will help you decide when to add services or invest in new equipment. Over time, higher equity will mean a stronger, more profitable business.

Keeping equity accounts up to date is also crucial for tax preparation and reporting to investors or lenders, as it will give a clear picture of your business’s worth.

Beyond templates: How Aspire boosts operational efficiency

Using a chart of accounts template is the first step in streamlining your landscaping business’s financial tracking.

You need an integrated system beyond manual data entry and management to boost operational efficiency.

Aspire’s landscaping business software will automate, track, and analyze every aspect of your business, from bookkeeping to operations. With Aspire, you can manage end-to-end workflows and improve productivity and financial visibility with the following best-in-class features.

1. Real-Time Reporting and Financial Tracking

Aspire’s platform will give you real-time reporting on all financial activity to see your income, expenses, and profit margins.

Eliminating manual updates streamlines and expedites making informed decisions. Aspire generates financial statements like income statements and balance sheets with the click of a button, saving time and reducing errors.

Automate cash flow reports to see your business’s liquidity.

Set up automatic accounts payable and accounts receivable alerts so bills are paid on time and revenue is collected quickly.

2. Integrated Job Costing and Estimating

Job costing is vital to determining your Cost of Goods Sold (COGS) and pricing services like lawn care, landscaping design, and irrigation installation.

Aspire’s platform will pull data from your expense accounts and calculate labor, materials, and equipment costs for each job in real-time, so operations can see when jobs are about to go over budget and make responsive resource allocation decisions.

Track project-specific costs and adjust pricing based on real-time financial data.

Pull historical data into your estimates to give quotes that protect your profit margins.

3. Streamlined Invoicing and Payments

Invoicing and payments can be a hassle, but Aspire's invoicing system makes it easy. You can create and send invoices from within the platform, and clients can pay with a credit card or ACH bank transfer via the customer portal, so you get paid quickly and easily.

Automate invoice creation based on completed jobs or recurring contracts.

Sync invoicing data with your chart of accounts to track revenue accurately.

4. Scheduling and Resource Allocation

Proper scheduling ensures your team, equipment, and materials are correctly allocated to each job. Aspire’s scheduling tools allow you to assign tasks to employees, monitor progress, and ensure all jobs are completed on time.

Track labor costs and allocate resources to prevent overbooking or underutilization.

Use real-time data to adjust schedules based on job complexity or priority.

5. Aspire Mobile App for Field Management

Aspire Mobile gives your team access to job details in the field, with offline capabilities and the ability to update project status. You can see geo-stamped hours worked from the office, ensuring all time and materials are reported accurately and reducing discrepancies between office records and fieldwork.

Let field workers check in and out of jobs with GPS-stamped entries to track labor accurately.

Upload photos or notes from the job site into the platform for better project management.

Mobile apps also allow business owners to manage their finances and critical data from anywhere, allowing them to stay connected and make decisions on the go.

Aspire will help you stay on top of your finances, optimize operations, and be profitable in the long run.

Back to you

An accurate, current chart of accounts, with income, expense, and equity accounts in order, gives business owners the tools to make decisions, simplify tax time, and be more efficient.

Aspire’s platform goes beyond templates, with real-time tracking, automated invoicing, and job costing to help you manage your finances smoothly.

To learn more about improving your financial management, check out our guides on how to start a landscaping business and common mistakes to avoid.

Ready to take your landscaping business to the next level? Book a demo with Aspire today to see how these features can transform your operations.