Table of Contents

Table of Contents

- Introducing Your Free Cleaning Business Income Statement Template

- How to Customize Your Income Statement Template

- Why Use a Cleaning Business Income Statement Template?

- What Are the Challenges of Financial Management for Cleaning Businesses?

- How Aspire Can Help You Streamline Your Cleaning Business Financial Management

- It’s Up to You Now

Having trouble keeping track of your cleaning company’s finances? You’re not alone.

Many cleaning business owners struggle to understand their financial situation without the right tools.

A financial statement, especially an income statement, is key to tracking income and expenses and determining a business's profitability.

Introducing Your Free Cleaning Business Income Statement Template

Managing a cleaning business doesn’t have to be hard.

Handling the business operations, including daily activities and strategic direction, is key to success.

Our free income statement template makes it easy to focus on what matters most – growing your business. Plus, our business plan template is much easier to use than Excel spreadsheets.

Key Features:

Easy to use: Designed for cleaning service providers, the template is simple even if you don’t have a financial background.

Business overview: Track your income, expenses, profit margins and net profit with clear categories and calculations.

Customizable: You can tailor the template to your cleaning business needs, whether you offer home cleaning, commercial cleaning or janitorial services.

Accurate financials: Get a clear view of your financial statements so you can make informed decisions about your business’s future.

Financial projections: Create detailed financial projections to guide your decision-making and attract investors by supporting funding requests with data and goals.

How to Customize Your Income Statement Template

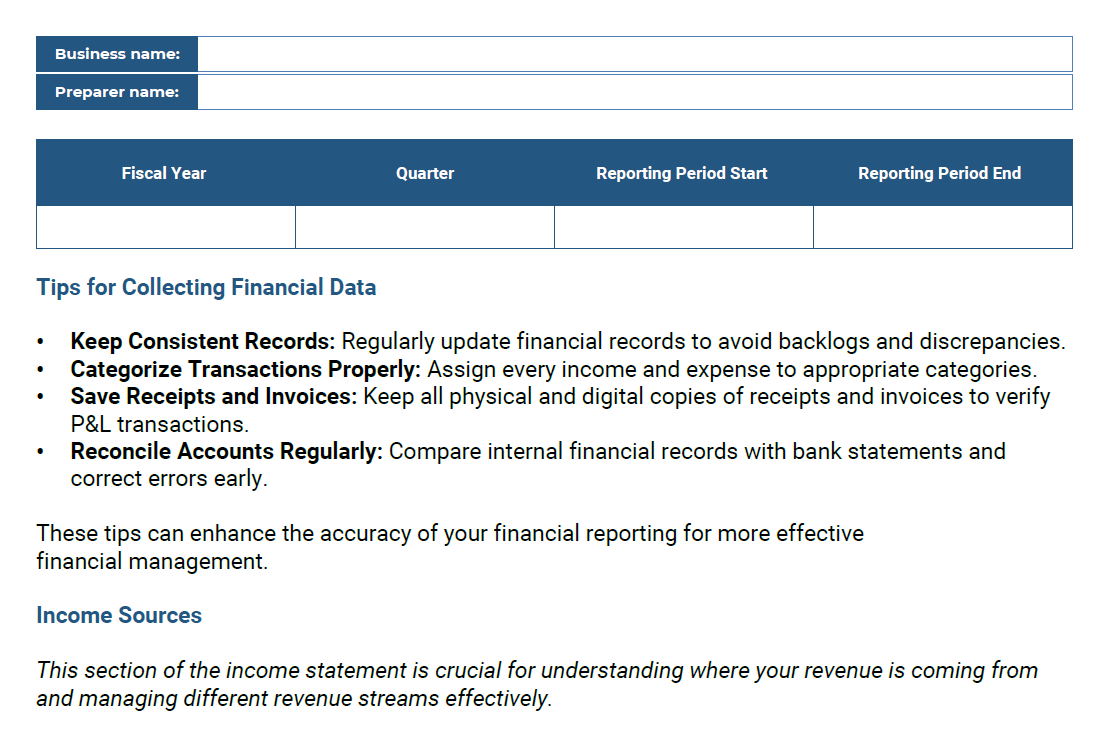

Customizing your cleaning business income statement is easy. Follow these steps:

Step-by-Step Instructions:

Income section:

List all income sources that generate income: carpet cleaning, window cleaning, and janitorial services.

Any other services: For instance, maintenance and installation

Categorize expenses:

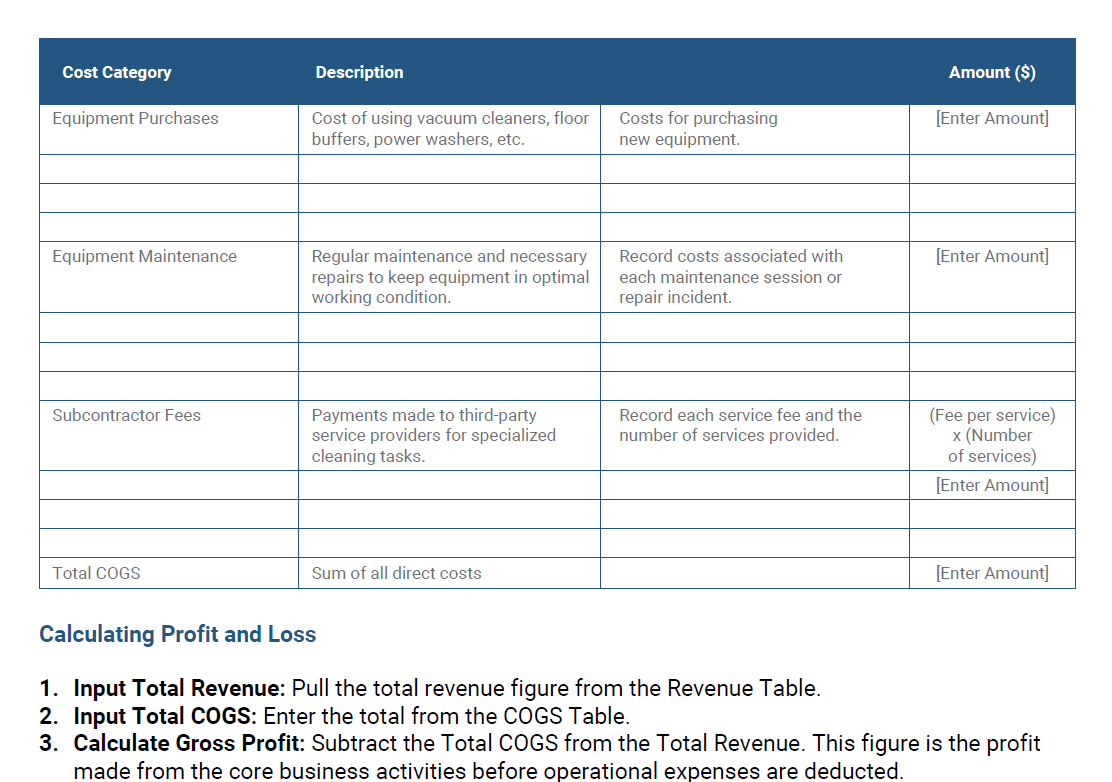

Operating expenses: cleaning supplies, wages, depreciation and startup costs.

Use categories that match your business plan for easier tracking.

Subtract total expenses from total income to get your net profit.

Use this to see how profitable your business is and where to improve.

Review your results:

Positive net income means you’re profitable, and negative means you must review your financial plan.

Update regularly:

Update the template monthly. Regular updates will give you better insight into your business’s financial situation.

Creating your income statement will give you valuable information to help you make informed financial decisions and keep your cleaning business plan on track.

Why Use a Cleaning Business Income Statement Template?

An income statement is a financial document that summarizes a business’s revenue, expenses and net income over a period. It gives insight into a company’s financial situation by showing how well it manages its resources.

The income statement also helps evaluate the company’s performance and gives a broad view of profitability and operational efficiency.

Components:

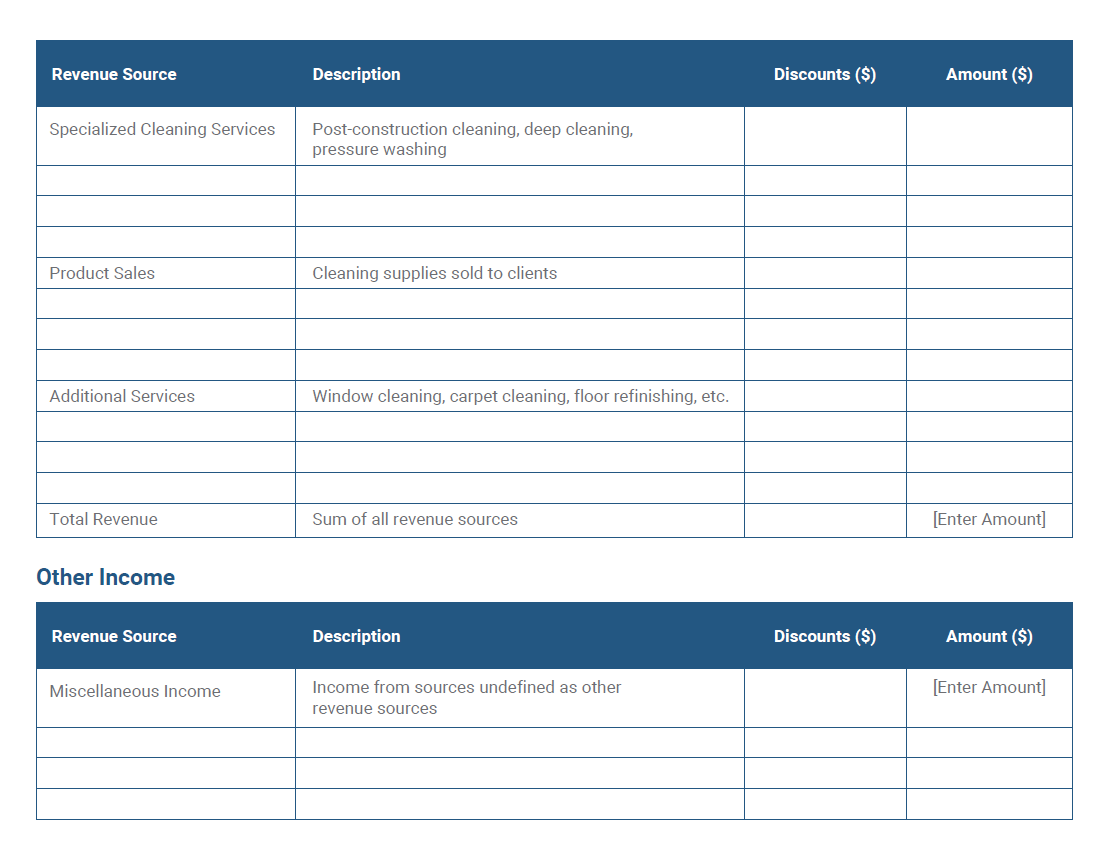

Revenue: Total income from cleaning services like carpet cleaning, window cleaning and more. This includes operating revenue from your core business activities. Revenue can also come from non-core business activities like maintenance or installation services that are unrelated to your main products or services.

Expenses: All expenditures of running your business, operating expenses, cleaning supplies and wages.

Net income: Profit after all expenses have been deducted from your revenue.

Advantages of an Income Statement:

Know your profitability: See clearly if your cleaning business is profitable.

Cost savings: Find where to cut costs to improve your bottom line.

Track progress: See how your financial situation changes over time, so you stay on track with your business financial goals. The income statement is produced more frequently, while other financial statements are produced annually.

Data-driven decisions: Use financial data to guide your growth and future financial decisions.

An updated income statement gives you the information to move your cleaning business forward.

What Are the Challenges of Financial Management for Cleaning Businesses?

Financial management for a cleaning business can be tough and stressful. The common challenges a cleaning service business faces are:

Difficulty in tracking income and expenses accurately: Without systems in place, it’s easy to lose track of where money is coming from and where it’s going, which can affect your cash flow statement. A balance sheet is important in this process as it gives a snapshot of the company’s financial situation by showing assets, liabilities and shareholders’ equity at a point in time. Understanding liabilities is key here as they represent the company’s financial obligations and overall financial stability.

Lack of clarity on profitability: Many cleaning business owners struggle to know if their business is really profitable or not, so they can’t measure success.

Difficulty making informed business decisions: Without financial data, like current assets and cost of goods, decision-making becomes a guessing game, hindering growth. Understanding your income statement is important as it shows your company’s profit or loss over time and whether you will break even.

Stress and wasted time on disorganized finances: Disorganized records and financial statements can cause unnecessary stress and wasted hours that could be spent on growing your business.

Now that you know the challenges, let’s get started. Use a financial model template to simplify financial management and return to what matters.

How Aspire Can Help You Streamline Your Cleaning Business Financial Management

Financial management for a cleaning business can be tough, as can tracking income and expenses, understanding profitability, and making informed decisions. Aspire has got you covered for all these financial management challenges so you can focus on growing your business.

Job costing:

Track all expenses related to each job, including labor, materials, and overheads.

Accurate billing and profitability analysis for each job.

Protect your profits with real-time job cost data.

Compare actual job costs with estimates and past performance to make better decisions.

Gains from the sale of fixed assets can also be tracked, so understanding asset management in financial reporting is important.

Real-time data and reporting:

No need to pull data from multiple sources; Aspire gives you instant access to your business information.

Use Aspire’s flexible profit and loss reporting to get a 360° view of your cleaning business – filter data by branch, division, service type and more for more detail.

Custom reports and dashboards: No more guessing with real-time insights to develop action plans. Get instant financial data to make decisions quickly.

Generate detailed reports to monitor performance.

Manage accounts receivable easily, improve cash flow, and get paid on time.

Payroll account management with accurate working capital: Track and manage employee wages as part of your operational expenses so you can process payroll accurately and on time.

Get a true valuation of your cleaning company and its profit margins.

Aspire simplifies your financials and gives you the data to make decisions that grow. Now it’s your turn.

It’s Up to You Now

Managing your small business finances doesn’t have to be hard. With the right tools, you can track income, expenses and profitability. Our free income statement template is a simple and powerful way to get clarity on your finances so you can make decisions and grow your business.

By using this template, you can:

Understand your business’s profitability.

Identify areas for cost savings.

Track your financial progress over time.

Book a free demo with Aspire to learn more about its comprehensive solution and how it can streamline your financial management process.