Successfully selling your landscaping business requires careful planning, accurate valuation, and strategic execution. This guide helps you achieve a profitable exit.

Assess your landscaping business value

Understanding your business’s true value is vital for a successful sale. Proper valuation methods should accurately reflect its value to ensure you set a fair price and get what you’re owed.

Multiple of Revenue

A multiple of revenue is a common method for valuing a business. This straightforward approach involves multiplying your annual revenue by an industry-specific factor, typically ranging from 0.5 to 2, depending on industry trends, economic conditions, and growth potential.

Unlike profit-based methods like EBITDA or SDE, the multiple revenue method focuses solely on gross sales, ignoring profitability and expenses. This can be a quick way to estimate value but might not capture the full financial health of the business. It is more suitable for businesses with stable and predictable revenue streams.

Example: If your landscaping business generates $500,000 annually and the industry multiple is 1.2, you value your business at $600,000. This method provides a quick estimate but should complement other valuation methods for a comprehensive view.

Seller’s Discretionary Earnings (SDE)

Seller’s Discretionary Earnings (SDE) focuses on earnings before owner compensation and discretionary expenses. It provides a clear picture of the profits a new owner can expect.

You calculate SDE by taking the net profit and adding back discretionary or owner-specific expenses, such as the owner’s salary, personal benefits, and non-essential business expenses. This figure represents the total financial benefit the owner derives from the business.

This method differs from EBITDA and revenue multiples by emphasizing the cash flow available to a new owner. It’s particularly useful for small businesses with significant owner involvement. While it provides a realistic earnings view, it requires detailed financial records.

Example: If your business has an annual profit of $150,000, with an additional owner’s salary and benefits amounting to $50,000, the SDE would be $200,000. This helps buyers see their expected total earnings.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

EBITDA provides a clear picture of operational profitability, excluding non-operational factors like financing and accounting decisions. You calculate EBITDA by taking net income and adding back interest, taxes, depreciation, and amortization. This figure highlights the business’s core earnings power without the influence of capital structure, tax rates, or non-cash accounting items.

EBITDA is especially useful for larger businesses or those seeking investment, as it shows the potential for operational cash flow and overall business performance. Investors use it to assess a company’s ability to generate profit and service debt.

Example: If your landscaping business has a net income of $120,000, with additional expenses for interest ($10,000), taxes ($15,000), depreciation ($5,000), and amortization ($3,000), the EBITDA would be $153,000. This metric helps buyers understand the business’s earning potential and operational efficiency.

Prepare your landscaping business for sale

Preparing your landscaping business for sale ensures a smooth and profitable transaction. Proper preparation enhances your business’s attractiveness, builds buyer confidence, and streamlines the sale process.

Financial Clean-up

Financial clean-up involves examining your financial affairs to give buyers a clear and attractive picture.

Clear any outstanding debts to present a financially stable business. Focus on improving your profitability margins by reducing unnecessary expenses and boosting revenue streams.

Tips for streamlining financial records:

Update Financial Statements: Regularly update your balance sheets, income, and cash flow statements.

Organize Receipts and Invoices: Ensure all transactions are well-documented and easily accessible.

Hire a Professional Accountant: Engage an accountant to review your records and provide a thorough financial audit.

Use Accounting Software: Implement reliable accounting software to manage your finances efficiently and accurately.

Organizing Documentation

Well-organized documentation builds buyer confidence and facilitates a smooth transaction. Ensure you have all necessary documents, including financial statements, tax returns, customer contracts, employee records, and operational manuals.

Tips for organizing and presenting documents:

Create a Checklist: List all required documents and regularly update it as you gather information.

Digital Storage: Use cloud storage to maintain digital copies of all documents, ensuring they are secure and easily accessible.

Professional Presentation: Organize documents into clearly labeled folders and provide summaries where necessary.

Legal Review: Have all documents reviewed by a legal professional to ensure compliance and completeness.

Confidentiality: Ensure sensitive information is protected and only shared with serious buyers under a non-disclosure agreement (NDA).

Enhancing Curb Appeal

Enhancing curb appeal goes beyond physical appearance; it encompasses all aspects that make the business attractive to buyers.

For instance, you could upgrade your equipment and facilities to demonstrate a well-maintained and efficient operation. Ensure all your machinery is in good working order and highlight successful projects by creating a portfolio that showcases your best work, including before-and-after photos and customer testimonials.

Refresh your online presence by updating your website and social media profiles, emphasizing your expertise and reputation.

With your business looking its best, it’s time to focus on finding the right buyer.

Find the right buyer

Finding the right buyer is about finding the ideal buyer who sees the value in your business and has the resources and vision to take it to the next level.

Individual Entrepreneurs

Individual entrepreneurs bring a personal passion and hands-on approach. They are highly relevant to landscaping, which benefits from personal attention and a strong owner presence.

Individual entrepreneurs can be highly motivated and committed, often bringing fresh ideas and energy. However, they might lack the financial resources or industry experience to scale the business.

Where to find this type of buyer:

Networking Events: Attend local business meetups and industry conferences, such as Chamber of Commerce events or landscaping expos.

Industry Associations: Join landscaping industry associations and participate in events like the National Association of Landscape Professionals (NALP).

Online Marketplaces: Platforms like BizBuySell and Flippa can connect you with individual buyers looking for small businesses.

Social Media: Utilize LinkedIn and Facebook groups focused on entrepreneurship and small business ownership. For example, LinkedIn groups for small business owners or Facebook groups for landscaping business enthusiasts.

Pros:

Personal Investment: Entrepreneurs are often deeply invested in the success of their new ventures.

Fresh Perspective: They bring new ideas and innovative approaches to the business.

Long-Term Commitment: Entrepreneurs usually seek long-term opportunities to grow their businesses.

Cons:

Financial Limitations: They may have limited financial resources, which can constrain growth and operations.

Learning Curve: They may lack industry knowledge of how to run a landscaping company.

Operational Challenges: They may require extensive training and support to manage the business effectively.

Strategic Buyers (such as Competitors)

Strategic buyers, such as competitors, offer unique advantages due to their industry knowledge and business networks. They often look to expand their market share and consolidate their presence.

However, confidentiality can be a concern, and merging different corporate cultures could present challenges.

Where to find this type of buyer:

Industry Events: Participate in landscaping trade shows and expos, such as the GIE+EXPO or the National Association of Landscape Professionals (NALP) events.

Direct Outreach: Contact competitors through professional networks like LinkedIn or industry-specific forums. For instance, reaching out to regional competitors who may be looking to grow their footprint.

Professional Advisors: Use brokers or consultants with industry connections. Firms like Sunbelt Business Brokers or Transworld Business Advisors know how to connect sellers with strategic buyers in landscaping.

Trade Publications: Advertise in industry-specific magazines and journals, such as Lawn & Landscape Magazine or Landscape Management. Industry professionals read these publications widely.

Pros:

Industry Knowledge: They understand the industry, leading to better business integration and a better understanding of why landscaping services companies fail.

Higher Offers: Strategic buyers often offer higher prices due to connections they can achieve.

Operational Synergies: They find efficiencies and cost savings by integrating your business.

Cons:

Confidentiality Concerns: Sharing sensitive information with competitors can be risky if the sale doesn’t proceed.

Post-Sale Integration Issues: Merging different corporate cultures can lead to conflicts.

Operational Changes: They may implement changes that alter how the business operates.

Private Equity Firms

Private equity firms look for profitable businesses to add to their portfolios. They bring financial strength and experience in business growth.

Private equity firms can invest significant resources into your business, driving growth and expansion. However, they may prioritize short-term gains and implement changes that alter the company’s culture.

Where to find this type of buyer:

Investment Conferences: Attend events like the Private Equity International (PEI) conferences. These gatherings attract private equity firms looking for investment opportunities.

Business Brokers: Brokerage firms specializing in selling businesses to private equity firms. Brokers can help you identify and connect with suitable companies.

Online Platforms: List your business on platforms like Axial, which connects businesses with private equity firms.

Pros:

Financial Strength: They have significant capital to invest, which can drive business growth.

Business Growth Experience: Their expertise can help scale your business more efficiently.

Resource Availability: They bring additional resources and strategic guidance.

Cons:

Operational Changes: They may make significant changes to operations to maximize ROI.

Complex Negotiations: The negotiation process can be lengthy and complex.

Short-Term Focus: They may prioritize short-term financial gains over long-term stability.

Existing Employees

Your current employees know the business well and may want to take over. This option can ensure continuity and preserve company culture and heritage.

Employees are already familiar with the operations and can provide a seamless transition. However, they might lack the financial or business acumen to purchase the business outright.

Where to find this type of buyer:

Internal Meetings: Discuss the potential sale with your management team and key employees. Gauge their interest in purchasing the business.

Management Discussions: Have in-depth conversations with potential employee-buyers about their vision and capabilities.

Incentive Programs: Develop programs, such as employee stock ownership plans (ESOPs), to assist employees in financing the purchase.

Pros:

Seamless Transition: Employees already understand the business operations and can ensure continuity.

Preserve Culture: They are likely to maintain the existing company culture.

Motivation: Employees may be highly motivated to succeed as new owners.

Cons:

Financial Constraints: Employees may lack the necessary funds to buy the business.

Potential Strained Relationships: Transitioning from employee to owner can strain existing relationships.

Need for Training: Employees may need additional training to handle business ownership responsibilities like marketing, which they may not have done previously.

Online Marketplaces and Business Brokers

Using online marketplaces and business brokers can significantly widen your pool of potential buyers. These platforms and professionals offer a professional approach and access to a broad audience, making it easier to connect with serious buyers.

Online marketplaces provide visibility to many potential buyers, while business brokers bring expertise and personalized service. However, broker fees can be high, and the process may take longer.

Where to find this type of buyer:

Online Business Sale Platforms: List your business on websites like BusinessBroker.net and LoopNet. Buyers searching for businesses to purchase use these platforms.

Professional Business Brokers: Engage brokers with experience in selling landscaping businesses. Firms can connect you with potential buyers.

Classified Ads: Advertise in relevant publications and online classifieds such as BusinessesForSale.com and industry-specific sites like Green Industry Pros.

Pros:

Broad Audience: Access to a wide range of potential buyers increases the likelihood of finding a suitable match.

Professional Guidance: Brokers provide expertise and support throughout the sales process.

Streamlined Process: Online platforms offer a structured process for listing and managing inquiries.

Cons:

Broker Fees: Hiring a broker can be expensive, with fees typically ranging from 5% to 10% of the sale price.

Less Personal Connection: Online transactions may lack the personal touch of direct negotiations.

Longer Sale Process: The process can take longer due to the time required to find the right buyer and complete negotiations.

Negotiate and Seal the Deal

Effective negotiation is crucial in the final stages of selling your landscaping business. It ensures that you and the buyer are satisfied with the terms and that the transaction proceeds smoothly.

Start by setting a realistic asking price based on your business valuation.

Be prepared to justify your price with solid financial data and industry benchmarks. Structure the deal to meet both parties’ needs, including options like seller financing, earn-outs, or installment payments.

To maintain trust, provide all requested documents promptly and transparently. Be flexible and open to negotiating terms such as payment structures, transition periods, and post-sales support.

Finally, you should use a lawyer who can help draft and review contracts, ensuring that all legal aspects are covered and protecting your interests. Their expertise can also help navigate any regulatory or compliance issues that arise.

With the deal successfully negotiated, you can look forward to ensuring a smooth transition for the new owner.

Invest in a landscaping business platform

Throughout this guide, we've discussed various ways to prepare your business for sale, including accurate business valuation, attracting potential buyers, and negotiating the final deal.

To help prepare your landscaping and lawn care business for sale, why not make it even easier using a platform like Aspire?

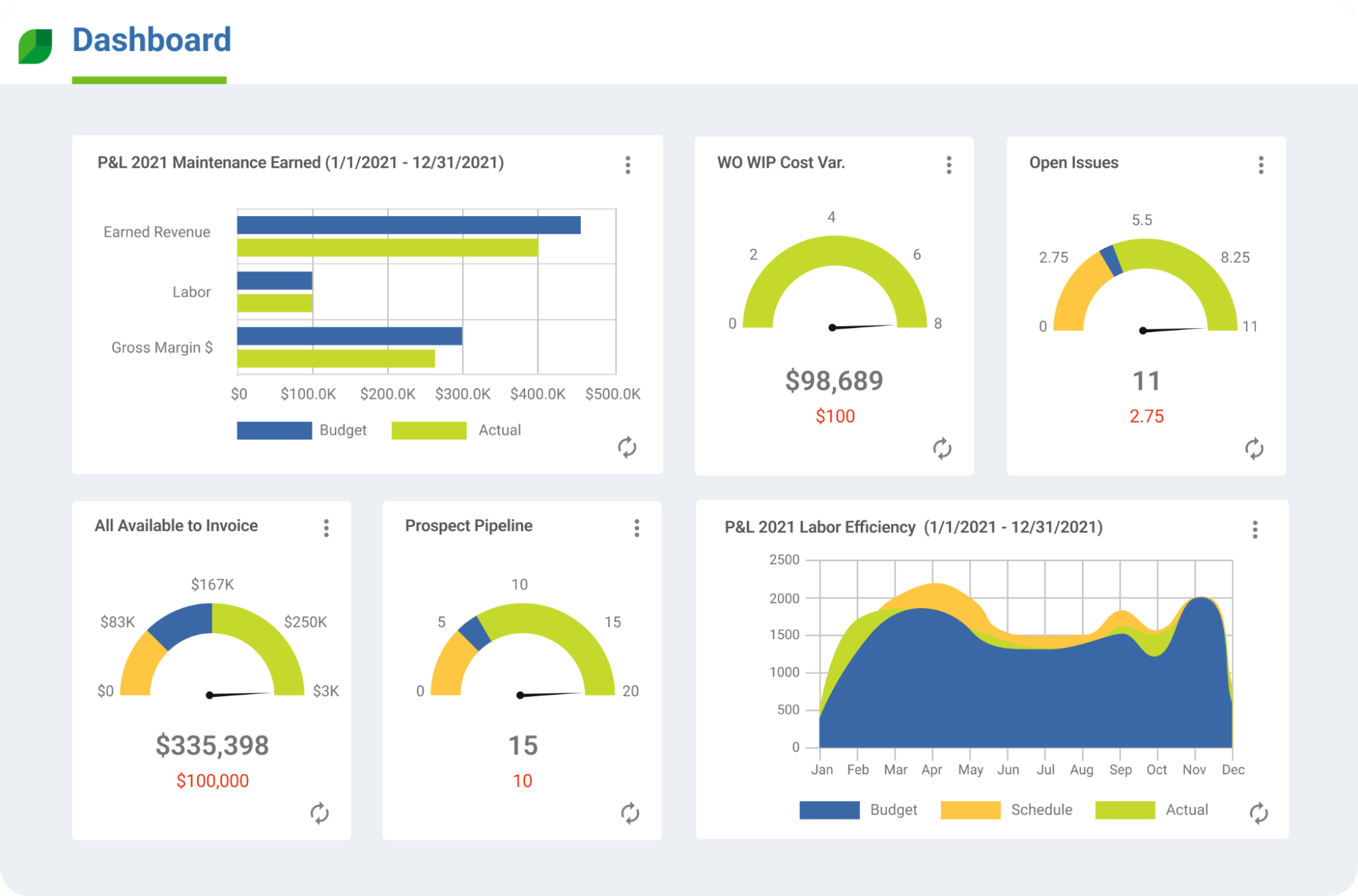

Aspire helps you manage accounts receivable, track your annual revenue, and maintain accurate balance sheets, which are crucial for potential buyers evaluating the value of your business. Whether you're calculating EBITDA, seller’s discretionary earnings (SDE), or assessing net profit, having detailed financial data readily available can significantly enhance your business valuation.

Even while you are preparing to sell, Aspire makes it straightforward for landscaping business owners to showcase their lawn care services, commercial clients, and long-term contracts.

It also helps present a well-organized management team and a solid customer base, which is attractive to strategic buyers, private equity groups, and individual entrepreneurs.

Integrating such a platform can improve your service business operations, making it more appealing to the right buyer. This investment supports a successful sale at a fair market value and ensures the continuity and growth of your landscaping business post-sale.

Book a free demo with Aspire to see how our platform can enhance your landscaping business operations and support a successful sale.

![Pricing commercial snow removal services & contracts [Guide] Pricing commercial snow removal services & contracts [Guide]](http://images.ctfassets.net/3cnw7q4l5405/3acYBdegrhUBOhNOS9iGR7/6626ed8cb1a74c987e29392a001c47d9/Pricing-Commercial-Snow-Removal-Blog_Featured-Image.jpg)